Seminars & Webinars

Stay Informed. Stay Compliant. Stay Ahead.

We’re committed to helping businesses stay updated with the latest changes in tax regulations, SST, and e-Invoice implementation. Through our seminars and webinars, we provide valuable insights, expert advice, and practical guidance — so you can make informed decisions and keep your business compliant.

Upcoming events

We regularly host both physical seminars and online webinars covering important topics that affect businesses of all sizes. Whether you prefer face-to-face learning or the convenience of joining online, our sessions are designed to be interactive, informative, and relevant to your business.

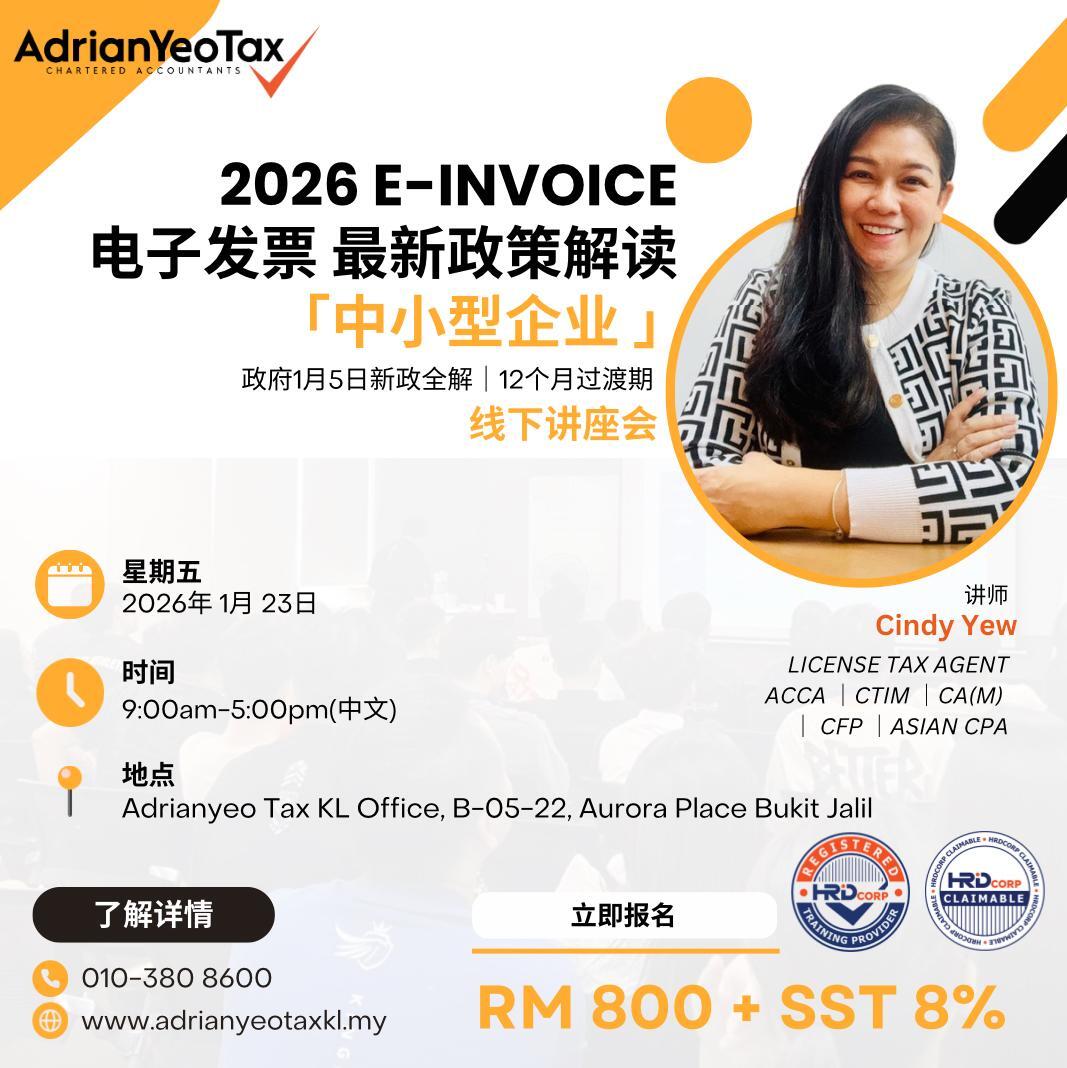

日期:2026年1月23日(星期五)

地点:Adrianyeo Tax KL Office

Date: 28 Oct 2025 (Tuesday)

Time: 10am–12pm ( Mandarin); 2pm–4pm ( English)Platform: Zoho Meeting

日期: 14/10/2025(星期二)

时间: 9:00am – 5:00pm

地点: AdrianYeo Tax KL Office, B-05-22, Aurora Place Bukit Jalil

Date: 9th October 2025, 2025 (Monday)

Venue: Menara Glomac Level 13A, TTDI, KL

Why join our sessions?

Our seminars and webinars are designed to turn complex tax and compliance updates into clear, practical knowledge. Led by experienced professionals, each session equips you with the insights, tools, and confidence to make informed business decisions and stay ahead of regulatory changes.

Stay Ahead of Changes: Get first-hand insights on new tax and compliance requirements.

Learn from Experts: Hear directly from our licensed tax professionals and industry practitioners.

Practical Knowledge: Gain actionable steps you can immediately apply in your business.

Networking Opportunities: Connect with other business owners and professionals facing similar challenges.

Free or HRD Corp Claimable: Most sessions are complimentary or HRD Corp claimable — making it easy to invest in knowledge.

Who should attend?

Our seminars and webinars are ideal for:

Business owners and directors

Finance and accounting teams

Entrepreneurs and startups

HR and payroll professionals

Anyone looking to understand Malaysia’s evolving tax landscape

Join our next session

Don’t miss out on valuable updates that impact your business.

Subscribe to our newsletter or follow us on social media to stay informed about upcoming events.